Resources

Welcome to our resources section, where you’ll find handy tools and information about upcoming events, FAQs, and a glossary to help you navigate common property investment terms.

Market Reports

Access in-depth market reports offering expert analysis of the UK property landscape. Our reports combine reliable data and forward-looking insights to help investors identify trends, assess performance, and make informed decisions across key regional markets.

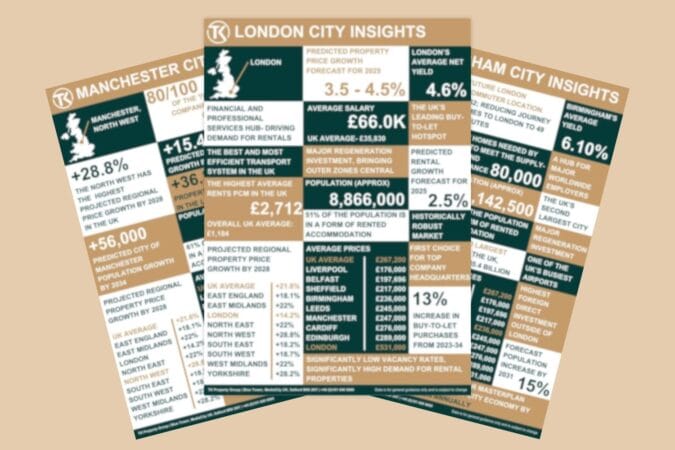

City Insights

Discover comprehensive city insights highlighting the latest property market trends, growth areas, and investment opportunities across major UK cities. Each guide provides a clear overview of local demand, regeneration projects, and rental performance to support your investment strategy.

Construction Updates

Stay informed on the progress of our developments with regular construction updates. Follow key build milestones, view site imagery, and track completion timelines to see your investment taking shape from start to finish.

Calculators

Use our easy-to-navigate property investment calculators to estimate rental yields, returns, and stamp duty costs. These tools are designed to give you a clear financial picture and help you evaluate potential investments with confidence.

FAQs

Find quick answers to the most common questions about UK property investment, buying processes, and our services. Our FAQs provide clear, practical guidance to support every stage of your investment journey.

Glossary

Explore our comprehensive property investment glossary, explaining key terms and industry jargon in straightforward language. It’s a valuable resource for both new and experienced investors looking to understand the UK market more clearly.

TK Property Group

Property Investment Resources

The TK Property Group Resources Hub brings together everything investors need to make informed decisions across the UK property market. From data-driven analysis to practical investment tools, our resources are designed to help you understand trends, calculate returns, and plan your next move with confidence.

Comprehensive

Market Reports and City Insights

Our detailed market reports and city insights offer reliable data and analysis on the UK’s leading property markets. Each report highlights key growth areas, regeneration updates, and rental trends in cities such as London, Manchester, Birmingham, Liverpool, and Nottingham. Investors can use these insights to identify the strongest opportunities and understand the long-term performance potential of each location.

TK Property Group’s research is built on verified data from high-authority sources including the Office for National Statistics (ONS), Gov.uk, and Savills, giving you confidence in every decision.

Track Progress with

Construction Updates

Stay connected to our ongoing developments through transparent construction updates. Each update provides details on build milestones, site progress, and completion timelines, allowing investors to monitor the status of their properties and see their investments come to life.

Investment Calculators

for Smarter Decisions

Our easy-to-use property investment calculators help you evaluate potential returns, rental yields, and stamp duty costs. These tools give investors a clear overview of financial performance, helping you compare opportunities and plan your investment strategy effectively.

Helpful

FAQs and Property Glossary

Our FAQs section answers common questions about the UK property investment process, from financing options to market timing and tax considerations. Meanwhile, our comprehensive glossary helps investors understand key property terms and industry jargon, making it easier to navigate every stage of the investment journey.

Empowering

UK Property Investors

TK Property Group is committed to providing transparent, data-driven insights that empower investors to make confident, informed decisions. Whether you are researching new markets, reviewing development updates, or assessing financial returns, our resources are here to guide your next investment.

To find out more about current opportunities or receive personalised investment advice, contact us today.