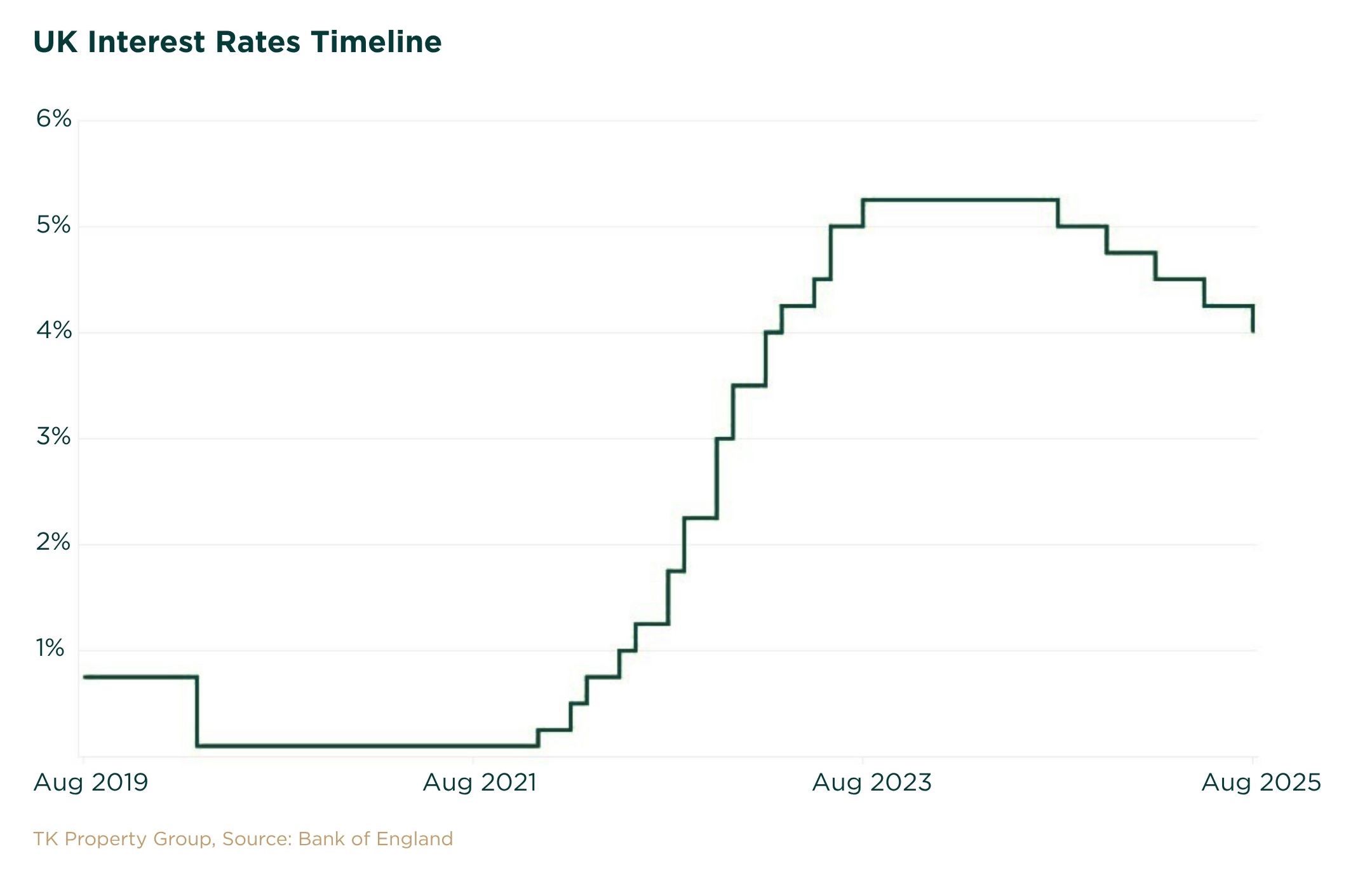

At 12pm on 7 August 2025, the Bank of England (BoE) announced a reduction in its base interest rate from 4.25% to 4.00%.

This marks the fifth consecutive cut since August 2024, as the central bank continues to ease monetary policy in response to slowing growth, rising unemployment, and persistent, though easing, inflation.

This article explores the implications of the UK interest rate cut in August 2025 on the property market, including mortgage trends, buyer behaviour, investor sentiment, and what to expect moving forward.

Why the Bank of England has announced UK Interest Rate Cut in August 2025

The Monetary Policy Committee (MPC) voted 6–3 in favour of a 25 basis point cut, citing:

- Flat GDP growth throughout Q2

- A rise in unemployment to 4.5%

- Inflation at 3.6%, still above target but steadily falling

Although inflation remains above the BoE’s 2% target, the central bank noted that much of the upward pressure comes from volatile components like energy and food prices. Core inflation has started to ease, providing room for policy support.

Source: Bank of England – Monetary Policy Report, August 2025

Mortgage Rates Begin to Ease

Lenders responded quickly to the announcement of UK Interest Rate Cut in August 2025. According to recent figures:

- 2-year fixed mortgage rates now average 4.52%

- 5-year fixed mortgage rates average 4.51%

Borrowers with strong credit and large deposits are seeing sub-4% deals return. This change is expected to boost:

- Remortgaging activity, especially for borrowers exiting 2023–24 fixed deals

- First-time buyer affordability, improving access to homeownership

- Buyer confidence, encouraging market re-entry before further rate shifts

Source: FCA – Mortgage Lending Statistics

Property Market Response: Stability Returns

Recent market data presents a mixed but stabilising picture:

- Halifax reported a 0.4% monthly rise in July house prices, bringing the UK average to £298,237

- ONS figures show annual house price growth at 1.2%, down from 5.6% a year earlier

- Rightmove recorded a 1.2% fall in asking prices, the steepest July decline in 20 years

Amanda Bryden, Head of Mortgages at Halifax, noted that UK house prices increased by 0.4% in July, equivalent to a £1,080 rise, marking the strongest monthly growth since early 2025. The average property value now stands at £298,237, which is 2.4% higher than the same period last year.

Lower interest rates could help reverse some downward pressure, though a full rebound is unlikely until early 2026. Regional markets such as Manchester, Leeds, and Nottingham are expected to see a quicker return to growth compared to London and the South East.

Sources: ONS – UK House Price Index and Halifax July 2025 House Price Index Report

Investor Sentiment and Buy-to-Let Strategy

Investor activity is increasing as borrowing costs fall. Key trends include:

- Buy-to-let landlords refinancing to improve yield margins

- HMOs and build-to-rent (BTR) units seeing strong demand in university cities

- Investors re-entering markets previously constrained by high borrowing costs

Example: A landlord refinancing a £300,000 mortgage from 6.0% to 4.5% could save over £300 per month, significantly improving net returns.

That said, landlords are also navigating:

- Affordability constraints that limit rent rises

- Potential regulatory changes (e.g. EPC minimum standards)

- Longer-term tax implications on portfolio income

Outlook for Developers and Off-Plan Investment

Lower interest rates improve market conditions for developers and off-plan investors. The UK interest rate cut in August 2025 has enhanced funding dynamics and boosted sentiment across the development sector. Benefits include:

- Easier access to development finance

- Improved exit values and loan-to-value conditions

- Increased off-plan buyer confidence, especially for 2026/27 completions

Areas showing resilience include:

- Urban regeneration zones with infrastructure investment

- Northern cities with high student and professional rental demand

- Mixed-use schemes offering blended yield potential

Currency Impact and Foreign Buyer Demand

Sterling weakened slightly following the rate cut, making UK property more attractive to overseas investors, particularly those using USD or pegged currencies.

Expect increased foreign interest in:

- Prime Central London (PCL)

- Zone 3–5 developments with high rental security

- Commercial conversions in high-demand regional centres

Source: HM Land Registry – Foreign Ownership Report

What’s Next after UK Interest Rate Cut in August 2025?

Markets now anticipate a further 0.25% cut in November 2025, potentially bringing the base rate to 3.75%. However, the BoE continues to emphasise a data-dependent approach, focusing on:

- Core inflation trends

- Employment and wage data

- Global economic and geopolitical developments

If inflation continues to fall and growth remains subdued, we could see a lower interest rate environment persist well into 2026.

Conclusion: What Should Investors and Buyers Do Now?

The Bank of England’s UK interest rate cut in August 2025 represents a pivotal moment in monetary policy that directly affects the property market. This easing of borrowing costs improves affordability for buyers and enhances returns for investors, signalling renewed opportunities across residential and buy-to-let sectors.

With the UK interest rate cut in August 2025, mortgage rates are falling, making financing more accessible and encouraging both first-time buyers and experienced landlords to enter or expand their market positions. Investor confidence is strengthening as refinancing options improve yield potential, while off-plan developments benefit from increased buyer demand and better funding conditions.

However, despite the positives, it remains crucial for investors and buyers to carefully assess risks such as regulatory changes, rental affordability pressures, and broader economic uncertainties that could influence future market performance.

Overall, the UK interest rate cut in August 2025 opens a window to capitalise on lower borrowing costs and stabilising market conditions. Those who move decisively now stand to benefit from the improving landscape, whether by refinancing, expanding portfolios, or entering the property market strategically.

Capitalise on the UK Interest Rate Cut in August 2025

With the UK interest rate cut in August 2025 now confirmed, investor confidence is returning and new opportunities are emerging across the property market. Whether you’re looking to refinance, expand your portfolio, or enter the market strategically, this is the time to act.

Speak to our team today for expert guidance on how to make the most of lower borrowing costs and rising demand.