Buy-to-Let Property Investment: Blackpool: High Yields in the UK’s Regeneration Hotspot

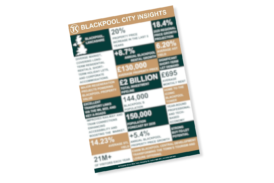

Blackpool is one of the most affordable cities in the UK, offering some of the country’s highest rental yields. Driven by £2 billion in targeted investment and a resilient tourism economy, investing in property in Blackpool provides exceptional cash flow and long-term capital growth potential tied to large-scale regeneration. A smart Blackpool buy-to-let property plan focuses on areas benefiting directly from new job creation and infrastructure.

Download City GuideKey Performance Indicators

Why Blackpool is a Top UK Investment City

£130,000

average house price Blackpool

6.20%

average AST Blackpool rental yields

+5.4%

Annual Blackpool property price growth

+8.7%

Annual Blackpool rental growth

£2 Billion

Total investment pipeline

Why Choose Blackpool

Blackpool

Market Summary

Market Summary

Blackpool Property Market Trends and Resilience

The Blackpool market's key strength is affordability. With an average property price of £130,000, it is highly accessible for investors seeking low entry costs. Price growth remains strong, with a recent +5.4 annual increase, higher than the North West regional average. The market is increasingly focused on the transition from traditional tourism to a year-round professional and tech-based economy, supported by major government and private investment. This pivot guarantees future price stability in regeneration areas.

Yields

Yields

Blackpool Buy-to-Let Rental Yields and Income

Blackpool is a national leader in rental yields, driven by low purchase prices and robust tenant demand. Average rental yields sit at a competitive 6.7% across the central area, with specialised segments (particularly flats) achieving returns up to 10.1%. Annual rental growth of +8.7% is highly attractive to cash-flow investors. The market is split between high-demand, low-cost long-term rental properties and a huge market for short-term holiday lets (STLs), offering dual income strategies for informed investors.

Regeneration

Regeneration

Major Regeneration Projects Powering Blackpool Property Value

Blackpool is undergoing a vast transformation, directly linking new professional job creation to property value uplift:

- Blackpool Central: A £300 million private sector-led scheme creating a world-class, year-round visitor attraction, which requires relocating the courts and will deliver a major boost to the visitor economy and job creation.

- Silicon Sands Enterprise Zone: A transformational £60 million+ project at Blackpool Airport to build a data centre campus, attracting thousands of well-paid jobs in digital and technology, providing a strong tenant base for high-quality BTL properties.

- Multiversity Campus: A £65 million project to relocate Blackpool and The Fylde College to a new town centre campus, bringing thousands of students and staff into the commercial heart of the town (FY1, FY3).

Connectivity

Connectivity

Blackpool Transport Links and Connectivity for Commuters

Improvements to transport are aimed at better connecting the town's core to regional employment and visitor hubs.

- Tramway Extension: A £34 million project extended the tram line to connect the Promenade directly with Blackpool North train station (FY1), a key transport hub. This significantly improves connectivity for commuters and tourists alike.

- Road Network: The M55 motorway connects Blackpool directly to the M6 and the national road network, facilitating easy commuting to nearby Preston, Manchester, and the Enterprise Zone.

- Rail: Blackpool North Station provides direct services to key national cities, including Manchester, Liverpool, and London (with a single change).

Areas Overview

Areas Overview

Best Areas to Invest in Blackpool Property for Strong Returns

Strategic investment should target the low-cost areas set to benefit from regeneration and professional jobs, or established residential zones.

- Central Blackpool (FY1)

Yield & Value-Add

Highest volume of sales and rentals. Offers superior yields (6.7%+) but requires careful selection due to high demand for refurbishment projects.

- Bispham (FY2)

Stable Residential

Regarded as one of Blackpool's most desirable and stable residential areas. Offers well-maintained family homes and flats, attracting long-term tenants and families.

- Marton (FY4)

Affordability & Connectivity

Offers high yields and benefits from proximity to the M55 motorway for commuters working outside Blackpool. Appeals to young families and workers.

- North Shore (FY1/FY2)

Premium/Coastal

More elegant Victorian/Edwardian properties. Appeals to higher-income professional tenants seeking proximity to the quieter coastline.

- Blackpool Airport Area (FY4/FY5)

Enterprise Zone Growth

The area surrounding the Silicon Sands development is poised for the strongest future capital growth as new, well-paid jobs arrive.

Our Portfolio

Featured Properties

No properties found in this location.