Abbey View, St Albans AL1 2PS

Forum House

Buy-to-Let property in a prime London commuter belt location...

1- & 2-bedroom apartments

AST Yields up to 6.4% | STL Yields up to 12.4%

18 Minutes to London Zone 1

Welcome to Forum House

Luxury Apartments in One of the UK’s Most Sought-After Commuter Cities

Forum House, St Albans presents a rare opportunity to secure a high-quality residential asset in one of the UK’s most desirable commuter locations. Situated at Abbey View, this boutique development offers a sophisticated collection of studios, one- and two-bedroom apartments, each designed with premium finishes and modern lifestyle features. Originally a commercial building, Forum House has been expertly converted into a vibrant residential community, maintaining architectural character while delivering contemporary living throughout.

Each apartment at Forum House showcases a high specification, featuring handleless kitchens fitted with Bosch appliances, sleek quartz worktops, and stylish porcelain-tiled bathrooms. Residents benefit from app-enabled heating and lighting controls and pre-installed gigabit-fibre broadband connections for seamless modern living.

Located just a minute’s walk from St Albans Abbey station and within easy reach of St Albans City station, residents enjoy direct Thameslink services to London St Pancras in under 20 minutes, making Forum House ideal for professionals and investors alike. The development is perfectly placed to enjoy the best of both worlds: a historic cathedral city rich in culture and green spaces, paired with exceptional connectivity to the capital.

St Albans’ property market has consistently demonstrated resilience and long-term growth, underpinned by strong demand and limited new housing supply due to Green Belt restrictions. With rental yields remaining healthy and capital appreciation forecast to continue, Forum House represents a secure and attractive investment opportunity.

Forum House, St Albans, combines lifestyle appeal, commuter convenience and investment strength, making it one of the standout residential developments currently available in Hertfordshire.

Contact us today to find out more about this exciting investment opportunity or click here to find out more about why London stands out as a prime city for property investment.

Key Details

- Located in St Albans, on the commuter belt north of London, England

- Boutique development of 63 units

- Property types: 1-bedroom & 2-bedroom apartments

- Off-plan, Completion Q1 2027

- Prices from: £280,000

- AST yields up to 6.4%

- STL yields up to 12.4%

- Tenure: 999 year leasehold

- No ground rent

- Parking spaces available

Luxury Amenities At

Forum House

The Apartments

1 Bedroom Apartments

Please be aware that prices displayed for 1-bedroom units at Forum House may reflect the lowest entry point available at the time of release. Availability and pricing are subject to change, and units at these prices may no longer be available.

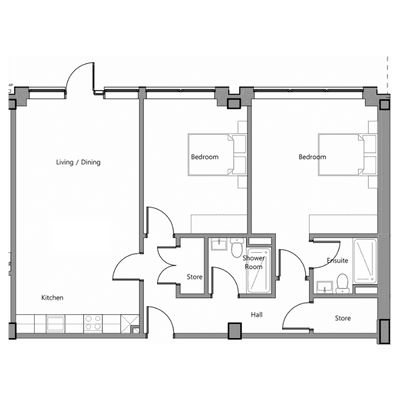

2 Bedroom Apartments

Please be aware that prices displayed for 2-bedroom units at Forum House may reflect the lowest entry point available at the time of release. Availability and pricing are subject to change, and units at these prices may no longer be available.

On the Map

Forum House

▸ London St Pancras International – 18 minutes by train

▸ St Albans City Station – 5 minute walk

▸ St Albans Abbey Station – 1 minute walk

▸ St Albans city centre and High Street – minutes on foot

▸ Verulamium Park – established green space nearby

▸ Clarence Park – central park and leisure destination

Why Choose London

London

Market Summary

Market Summary

London Property Market Trends and Resilience

The London market is bifurcated. While Prime Central London (PCL) has experienced slow growth, Outer London (Zones 3-6) is highly competitive and resilient. The market's stability is driven by strong economic fundamentals and persistent undersupply. Experts forecast steady, single-digit annual growth, leading to a cumulative +18.2% growth by 2030. London property investors should focus on the affordability factor in outer boroughs, where prices (starting near £350,000) are far more accessible, leading to higher transaction volumes and greater liquidity.

Yields

Yields

London Buy-to-Let Rental Yields and Income

Rental demand in London is at a historic high, with rents reaching UK records. This intense competition has created a clear geographical divide in yields:

- PCL (Zone 1): Typically lower yields 2.5%-3.5% due to ultra-high entry prices, focusing on capital preservation.

- Outer Boroughs: Offer the best returns, with areas like Barking & Dagenham (RM postcodes) and Croydon (CR0) frequently delivering 5.0% to 7.6% yields.

Rental growth is expected to continue rising at 5%-6% annually across Outer London, ensuring robust rental income despite high entry costs.

Regeneration

Regeneration

Major Regeneration Projects Driving London Property Value

- The Elizabeth Line (Crossrail): This 100km line is the single biggest driver of recent growth. Stations in areas like Woolwich (SE18), Abbey Wood (SE2), and Ilford (IG1) have seen significant uplift and guaranteed demand due to drastically reduced journey times to Canary Wharf and the West End.

- Royal Docks: £8 billion in funding is transforming this area into a new global business and residential destination, supporting growth in Newham and Dagenham.

- Old Oak Common: This new western transport hub will spur massive residential development, unlocking significant investment potential in the surrounding W3 and NW10 postcodes.

Connectivity

Connectivity

London Transport Links: The Crossrail Effect and Future Growth

Transport connectivity is the engine of London property value.

- The Elizabeth Line: The backbone of modern commuting, its influence is reflected in premium rents and strong capital growth along the route.

- Tube & DLR: The dense network provides unparalleled access to employment hubs (Canary Wharf, The City). Investors often prioritize properties within a 10-minute walk of a Zone 2 or 3 station for optimal tenant demand.

- HS2 (Future): While controversial, the new high-speed rail will further cement London's role as a national business gateway, underpinning long-term property values near major interchange points like Euston and Old Oak Common.

Areas Overview

Areas Overview

Best Areas to Invest in London Property for Strong Returns

A successful London investment requires focusing on the periphery where affordability, infrastructure, and yield potential align. These areas benefit from excellent commuter links while offering better returns than inner zones.

- Old Kent Road (SE1/SE15)

Major Regeneration & Capital Growth

A major Opportunity Area expected to deliver 12,000 new homes. Value is tied to the proposed Bakerloo Line Extension (BLE), guaranteeing significant future uplift.

- Cockfosters (EN4)

Yield & Premium Commuter

Offers some of the highest yields in the Barnet Borough (4.7%) due to accessible Northern Line connectivity. Ideal for professionals seeking quick access to Central London.

- Barnet (EN5, N12)

Stability & Family Appeal

Known for excellent schools and a village-like feel. Attracts families and long-term tenants, offering reliable income and steady capital appreciation.

- Cricklewood (NW2)

Value & Connectivity

Offers high yields (5.4\% in nearby Colindale/NW9) for its Zone 2/3 proximity. Benefits from Thameslink and has seen respectable 15.7% 5-year growth.

- Gravesend (DA11/DA12)

Affordability & Fast Rail

Outside London but connected by HS1 (High Speed 1). Excellent commuter link to St Pancras International (24 mins). Offers superior yields (up to 6.2%) due to lower house prices.

- St Albans (AL1/AL3)

Blue-Chip Commuter

A highly desirable commuter city (20 mins to London St Pancras). High prices mean lower yields (2.8% - 4.6%), but offers exceptional capital preservation and high-income tenant quality.