Kent Street, Birmingham, B5 6RD

Southside Residencies

Prime Birmingham regeneration zone investment

1- & 2-bedroom apartments

Yields up to 7.95%

Smithfield regeneration zone

Southside Residences – Birmingham’s City-Centre Investment Opportunity

Situated in the thriving heart of Birmingham’s Southside district, Southside Residences offers a boutique collection of luxury apartments in one of the UK’s most dynamic urban regeneration zones. This development comprises approximately 146 one- and two-bed units (with some three-bed options), cleverly designed for modern living and investor appeal. Located near the city’s cultural, retail and entertainment hubs, and adjacent to the major Smithfield regeneration scheme, the project presents outstanding access to employment, transport and lifestyle amenities.

The area’s transformation is well underway, with significant infrastructure improvements, a booming tech and creative sector, and a growing young professional population driving rental demand. With city-centre living in high demand and limited new supply, Southside Residences stands out as a strategic investment suited to both cash-flow and long-term capital growth. Apartments feature high-spec finishes, premium appliances, open-plan layouts, and strong connectivity across Birmingham and beyond.

For investors, Southside Residences delivers compelling fundamentals. Competitive entry prices, strategic location in a major regional city, projected gross yields of up to around 7 – 8 %, and the benefit of large-scale area regeneration combine to offer a robust proposition. With just a modest deposit required and favourable payment terms, this development makes quality city-centre investment accessible and future-proof.

Contact us today to find out more about this exciting investment opportunity.

Key Details

- Boutique city-centre apartments (~146 units)

- One- & two-bed (some three-bed) apartments

- Prime Southside district of Birmingham city-centre

- Entry prices from approx. £225,995

- Gross rental yields up to ~7 – 8 %

- Leasehold with 999-year term (or comparable long lease)

- No ground rent or minimal ground rent structure

- High specification finishes, designer kitchens & integrated appliances

- Direct access to culture, entertainment, retail and transport hubs

- Positioned within the Smithfield regeneration zone

Amenities At

Southside Residencies

Get In Touch

Want to know more about Southside Residencies?

The Apartments

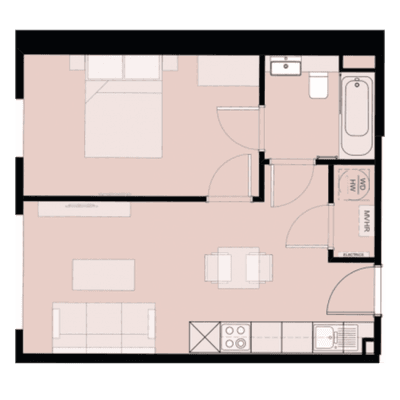

1 Bedroom Apartments

Please be aware that prices displayed for 1-bedroom units at Southside Residencies may reflect the lowest entry point available at the time of release. Availability and pricing are subject to change, and units at these prices may no longer be available.

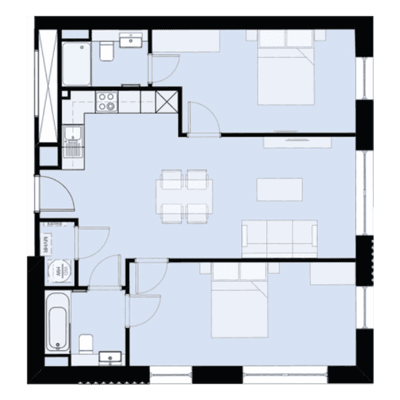

2 Bedroom Apartments

Please be aware that prices displayed for 2-bedroom units at Southside Residencies may reflect the lowest entry point available at the time of release. Availability and pricing are subject to change, and units at these prices may no longer be available.

Why Choose Birmingham

Birmingham

Market Summary

Market Summary

Birmingham Property Market Trends and Performance

The Birmingham property market is strategically positioned for growth. Forecasts suggest the West Midlands region will see a +27.6% property price growth over five years, outpacing the UK average of 24.5%. This resilience is built on strong demand, fuelled by a forecasted 15% population growth by 2031. As a result, rental prices are also predicted to soar, with a +22.2% rental increase by 2028 (compared to the UK average of 17% by 2029), making it a high-confidence market for capital appreciation.

Yields

Yields

Birmingham Buy-to-Let Rental Yields and Income

Birmingham's rental yields are strong, averaging 6% for traditional buy-to-let (BTL) and reaching 9% for short-term let (STL) strategies in central, high-demand areas. This is primarily due to a severe housing shortage: Birmingham's housing delivery is only meeting around 60% of its annual target, resulting in an estimated deficit of approximately 3,243 homes per year. Amidst the city’s pressing need for 89,000 new homes by 2031, this undersupply guarantees fierce competition for rental properties, creating a lucrative opportunity for investors.

Regeneration

Regeneration

Major Regeneration Projects in Birmingham

Massive investment across the city guarantees future property price inflation:

- Smithfield: This £1.9 billion, 17-hectare regeneration site in the heart of Birmingham is one of the largest single city centre developments in the UK. With £172.8 million in grant funding allocated, Smithfield will deliver 3,000+ new homes and 10,000+ jobs.

- Big City Plan: This city framework outlines the expansion of Birmingham’s core by 25%, dividing it into distinct quarters such as Digbeth and the Jewellery Quarter. The regeneration aims to enhance connectivity, create up to 50,000 new jobs, and contribute around £2.1 billion to the local economy, strengthening tenant demand beyond the traditional city centre.

- UK Economic Engine: Birmingham's thriving finance and tech sectors, bolstered by major corporate relocations, position it as a key UK economic hub outside of London.

Connectivity

Connectivity

Birmingham Transport Links and Connectivity for Commuters

Birmingham is rightly known as the "Crossroads of the UK," with 90% of the UK's population less than a four-hour drive away via the M5, M6, M40, and M42 motorways. This exceptional connectivity is crucial for attracting quality long-term tenants.

- HS2 Transformation: The construction of the future HS2 Curzon Street Station is the key driver of future value, cutting the rail journey time to London to approximately 49 minutes. This proximity will push property values in the Eastside and Colmore districts.

- Midland Metro: The Metro is actively expanding, with the Eastside Extension reaching into key investment areas like Digbeth and the future HS2 station, significantly improving city-wide access for residents.

- Air & Rail: Birmingham Airport (BHX) provides international connectivity, and Birmingham New Street remains the busiest rail hub outside London, ensuring high-speed access across the country.

Areas Overview

Areas Overview

Best Birmingham Areas For Buy-to-Let Property

- City Centre (B1/B3)

Capital Growth & Premium Rent

Attracts high-earning tenants due to corporate relocations (PwC, Goldman Sachs) to Paradise Circus.

- Digbeth (B5/B9)

Regeneration Hotspot

Central to the massive Smithfield project and served by the new Metro line. High capital growth forecast.

- Jewellery Quarter (B18)

Heritage & Stability

High demand for unique, character-filled conversion apartments. Strong community and lifestyle appeal.

- Colmore District (B3)

Professional Commuter

Premium location near the financial district and the future HS2 Curzon Street Station. Excellent for capital preservation.