Triskelion Wy, Liverpool L3 0BY

Aquitania

Prime Liverpool waterfront investment

1- & 2-bedroom apartments

Yields up to 7.5%

Waterside setting minutes from the city centre

Modern waterside living in Liverpool’s Central Docks

Aquitania Liverpool is the final phase of the Central Docks at West Waterloo Place, offering 135 high-specification waterside apartments and duplex homes. Each residence features contemporary interiors, floor-to-ceiling glazing, Juliet balconies and premium fixtures designed for modern living with expansive views over the Leeds Liverpool Canal and River Mersey. The development brings together light, space and sophisticated finishes that appeal to both owner-occupiers and investors.

Located in Liverpool’s £5 billion growth district at Liverpool Waters, Aquitania sits on an island site just minutes from the Royal Albert Dock, Liverpool’s business district and vibrant food quarter. The neighbourhood is a central focus for long-term regeneration and connectivity, supporting strong demand for quality rental housing from professionals, creatives and city dwellers alike.

From an investment perspective, Aquitania Liverpool presents a standout opportunity. With projected yields up to around 7.5%+ and a prime waterfront address within a highly sought-after regeneration zone, this development combines income potential with strong long-term capital growth fundamentals in one of the UK’s most dynamic regional markets.

Contact us today to find out more about this exciting Liverpool investment opportunity or click here to find out more about why Liverpool stands out as a prime city for property investment.

Key Details

- 135 high-spec waterside apartments and duplexes

- One- and two-bedroom homes

- Central Docks, Liverpool Waters (L3)

- Prime waterfront location with canal & river views

- Projected yields up to ~7.5%+

- Completion expected Q1 2025

- Juliet balconies and floor-to-ceiling windows

- Premium interiors with integrated appliances

- EV charging stations and smart home tech

- Minutes from Royal Albert Dock and city centre amenities

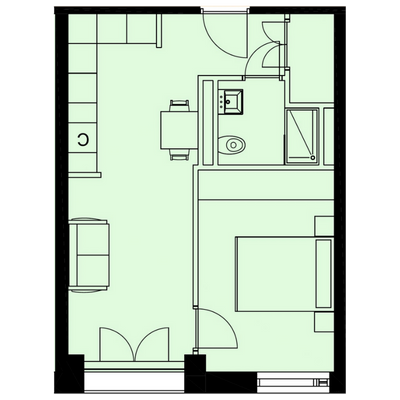

The Apartments

1 Bedroom Apartments

2 Bedroom Apartments

Why Choose Liverpool

Liverpool

Market Summary

Market Summary

Liverpool Property Market Trends and Resilience

The Liverpool market is defined by affordability and high returns. The city consistently outperforms national averages for rental yield, making it ideal for cash flow investors. Property prices are projected to rise by 20% by 2026, driven by low entry prices and strong investor interest. The market's resilience is built on high demand and low vacancy rates, with terraced properties being the strongest-performing segment, seeing growth of over 14.7% in the past year.

Yields

Yields

Liverpool Buy-to-Let Rental Yields and Income

Liverpool boasts some of the highest rental yields in the entire UK, consistently achieving 7.0% - 7.5% on average for buy-to-let properties in key areas. This is driven by a critical undersupply of rental properties and a dual tenant market: a large student population and a growing young professional base attracted by affordable city living. Average monthly rents have surged by nearly 10% annually, ensuring strong, steady income returns for buy-to-let investors in Liverpool, particularly those targeting houses in multiple occupation (HMO) near university campuses.

Regeneration

Regeneration

Major Regeneration Projects Powering Liverpool Property Value

- Liverpool Waters: This ambitious £5.5 billion, 30-year scheme is transforming the historic northern docks (L5, L20) into five new mixed-use neighbourhoods. It will deliver thousands of new homes, business space, and the new Everton FC stadium at Bramley-Moore Dock, acting as a massive anchor for property price uplift.

- Knowledge Quarter Gateway: A £2 billion investment creating a hub for technology, science, and education employers around Lime Street (L3, L7), attracting high-earning professional and academic tenants.

- Anfield & Local Projects: Ongoing, targeted regeneration around the Anfield Stadium (L4) and schemes like Project Jennifer at Great Homer Street (L5) are improving local amenities and housing stock, ensuring localised price stability and growth.

Connectivity

Connectivity

Liverpool Transport Links and Connectivity for Commuters

Liverpool's transport infrastructure is efficient and a key factor in attracting quality long-term tenants to buy-to-let property in the city.

- Merseyrail Network: This forms the crucial backbone of commuter transport, offering fast and frequent connections throughout the city region, including the Wirral. Property demand remains highest in areas with close access to Merseyrail stations.

- National Rail: Liverpool Lime Street connects the city to London, Manchester, and other major hubs, supporting the influx of professionals and supporting the city's role in the Northern Powerhouse.

- Road Network: Excellent links to the M62 and M57 provide easy access to the wider North West business parks and regional employment corridors.

- Air Travel: Liverpool John Lennon Airport (LPL) provides essential domestic and European connectivity, supporting the city’s international business appeal.

Areas Overview

Areas Overview

Best Areas to Invest in Liverpool Buy-to-Let Property

A targeted approach is essential, focusing on the postcodes with the highest yields or the most regeneration upside.

- Anfield / Walton (L4)

Highest Yield & Affordability

Consistently boasts some of the UK's highest yields (7.7% - 9.9%). Driven by the stadium's global appeal and low entry prices (£115,000).

- Bootle (L20)

Value & Regeneration

Offers high yields (7.5%) on an average property price of £120,347. Benefits from proximity to the Port of Liverpool and planned local investment.

- City Centre (L1 / L3)

Capital Growth & Professional Rent

Home to the Baltic Triangle (named the UK's coolest place to live). Strong growth (+38% over 5 years) and high rental income from young professionals.

- Kensington / Edge Hill (L7)

Student Market Focus

Bordering the Knowledge Quarter and universities. Guarantees constant student tenant demand, ideal for reliable HMO income.

- Everton / Vauxhall (L5)

Regeneration Upside

Seeing a massive surge in value (up to 75% growth over 5 years) driven by the Liverpool Waters project and the new Everton FC stadium construction.