Claremont Road, Cricklewood, London, NW2

Cricklewood Quarter

Greater London investment opportunity...

1-, 2- & 3-bedroom apartments

Yields up to 6%

Short distance to central London Zone 1

Welcome to Cricklewood Quarter, Cricklewood, London

Located in the vibrant heart of North London, Cricklewood Quarter is a landmark new development on Claremont Road, bringing 251 contemporary one-, two-, and three-bedroom apartments to the thriving Cricklewood community. Set across three architecturally distinct blocks, the development blends modern design with a strong sense of neighbourhood character. Just 500 metres from Cricklewood Station and surrounded by independent shops, cafés, and green spaces, residents benefit from urban convenience paired with everyday comfort and connection.

Cricklewood is one of London’s most exciting growth zones, forming part of the £10 billion Brent Cross Cricklewood regeneration masterplan. This transformative project is reshaping the area into a sustainable and inclusive urban destination, complete with upgraded transport links, new parks, schools, office space, and leisure facilities. Once complete, Brent Cross Town will deliver 6,700 new homes, 50 acres of open green space, and 3 million square feet of office space, creating a dynamic mixed-use community designed for long-term growth and prosperity.

For investors and homeowners alike, Cricklewood Quarter represents the opportunity to secure a high-quality property in one of London’s most promising regeneration areas. The development combines strong transport connectivity, exceptional design, and the long-term capital growth potential associated with large-scale infrastructure investment. With gross rental yields of up to 5.5%, zero ground rent, and a 999-year lease, it offers both immediate appeal and enduring value.

Waterside living, vibrant green spaces, and the proximity to central London make this development an ideal choice for buy-to-let investors property seeking strong returns and for owner-occupiers wanting a modern London lifestyle in a rapidly evolving location.

Contact us today to find out more about this exciting investment opportunity or click here to find out more about why London stands out as a prime city for property investment.

Key Details

- Prime North London location

- 500m from Cricklewood Station

- Direct Thameslink to St Pancras, Farringdon, and Blackfriars

- Part of £10bn Brent Cross Cricklewood regeneration

- 251 one-, two-, and three-bedroom apartments

- Completion: Block 1 (Q4 2026/Q1 2027), Block 3 (Q4 2027/Q1 2028)

- Gross yield up to 5.5%

- 999-year leasehold

- Zero ground rent

- Service charge: £3.31 psf (Block 1) / £2.88 psf (Block 3)

- Flexible spaces for modern London living

- Surrounded by parks, cafés, and shops

- Strong rental and capital growth potential

Amenities At

Cricklewood Quarter

Get In Touch

Want to know more about Cricklewood Quarter?

The Apartments

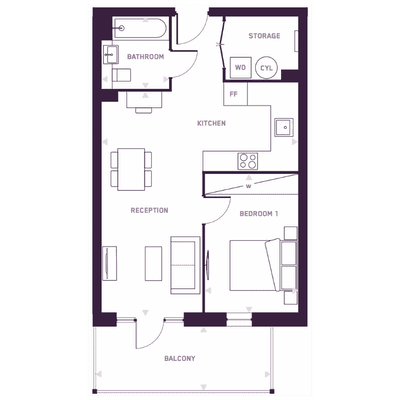

1 Bedroom Apartments

Please be aware that prices displayed for 1-bedroom units at Cricklewood Quarter may reflect the lowest entry point available at the time of release. Availability and pricing are subject to change, and units at these prices may no longer be available.

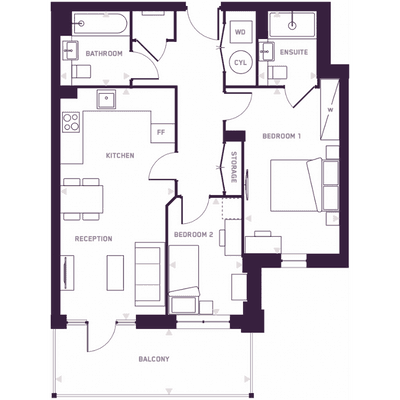

2 Bedroom Apartments

Please be aware that prices displayed for 2-bedroom units at Cricklewood Quarter may reflect the lowest entry point available at the time of release. Availability and pricing are subject to change, and units at these prices may no longer be available.

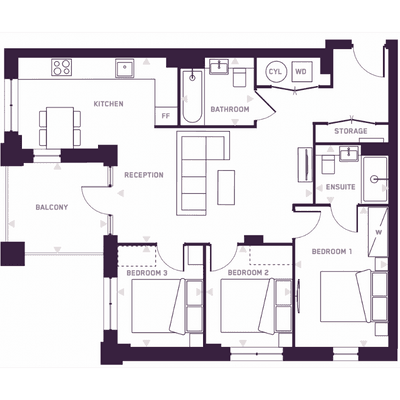

3 Bedroom Apartments

Please be aware that prices displayed for 3-bedroom units at Cricklewood Quarter may reflect the lowest entry point available at the time of release. Availability and pricing are subject to change, and units at these prices may no longer be available.

Why Choose London

London

Market Summary

Market Summary

London Property Market Trends and Resilience

The London market is bifurcated. While Prime Central London (PCL) has experienced slow growth, Outer London (Zones 3-6) is highly competitive and resilient. The market's stability is driven by strong economic fundamentals and persistent undersupply. Experts forecast steady, single-digit annual growth, leading to a cumulative +18.2% growth by 2030. London property investors should focus on the affordability factor in outer boroughs, where prices (starting near £350,000) are far more accessible, leading to higher transaction volumes and greater liquidity.

Yields

Yields

London Buy-to-Let Rental Yields and Income

Rental demand in London is at a historic high, with rents reaching UK records. This intense competition has created a clear geographical divide in yields:

- PCL (Zone 1): Typically lower yields 2.5%-3.5% due to ultra-high entry prices, focusing on capital preservation.

- Outer Boroughs: Offer the best returns, with areas like Barking & Dagenham (RM postcodes) and Croydon (CR0) frequently delivering 5.0% to 7.6% yields.

Rental growth is expected to continue rising at 5%-6% annually across Outer London, ensuring robust rental income despite high entry costs.

Regeneration

Regeneration

Major Regeneration Projects Driving London Property Value

- The Elizabeth Line (Crossrail): This 100km line is the single biggest driver of recent growth. Stations in areas like Woolwich (SE18), Abbey Wood (SE2), and Ilford (IG1) have seen significant uplift and guaranteed demand due to drastically reduced journey times to Canary Wharf and the West End.

- Royal Docks: £8 billion in funding is transforming this area into a new global business and residential destination, supporting growth in Newham and Dagenham.

- Old Oak Common: This new western transport hub will spur massive residential development, unlocking significant investment potential in the surrounding W3 and NW10 postcodes.

Connectivity

Connectivity

London Transport Links: The Crossrail Effect and Future Growth

Transport connectivity is the engine of London property value.

- The Elizabeth Line: The backbone of modern commuting, its influence is reflected in premium rents and strong capital growth along the route.

- Tube & DLR: The dense network provides unparalleled access to employment hubs (Canary Wharf, The City). Investors often prioritize properties within a 10-minute walk of a Zone 2 or 3 station for optimal tenant demand.

- HS2 (Future): While controversial, the new high-speed rail will further cement London's role as a national business gateway, underpinning long-term property values near major interchange points like Euston and Old Oak Common.

Areas Overview

Areas Overview

Best Areas to Invest in London Property for Strong Returns

A successful London investment requires focusing on the periphery where affordability, infrastructure, and yield potential align. These areas benefit from excellent commuter links while offering better returns than inner zones.

- Old Kent Road (SE1/SE15)

Major Regeneration & Capital Growth

A major Opportunity Area expected to deliver 12,000 new homes. Value is tied to the proposed Bakerloo Line Extension (BLE), guaranteeing significant future uplift.

- Cockfosters (EN4)

Yield & Premium Commuter

Offers some of the highest yields in the Barnet Borough (4.7%) due to accessible Northern Line connectivity. Ideal for professionals seeking quick access to Central London.

- Barnet (EN5, N12)

Stability & Family Appeal

Known for excellent schools and a village-like feel. Attracts families and long-term tenants, offering reliable income and steady capital appreciation.

- Cricklewood (NW2)

Value & Connectivity

Offers high yields (5.4\% in nearby Colindale/NW9) for its Zone 2/3 proximity. Benefits from Thameslink and has seen respectable 15.7% 5-year growth.

- Gravesend (DA11/DA12)

Affordability & Fast Rail

Outside London but connected by HS1 (High Speed 1). Excellent commuter link to St Pancras International (24 mins). Offers superior yields (up to 6.2%) due to lower house prices.

- St Albans (AL1/AL3)

Blue-Chip Commuter

A highly desirable commuter city (20 mins to London St Pancras). High prices mean lower yields (2.8% - 4.6%), but offers exceptional capital preservation and high-income tenant quality.